Introduction to Python for Finance

Build Python skills to elevate your finance career. Learn how to work with lists, arrays and data visualizations to master financial analyses.

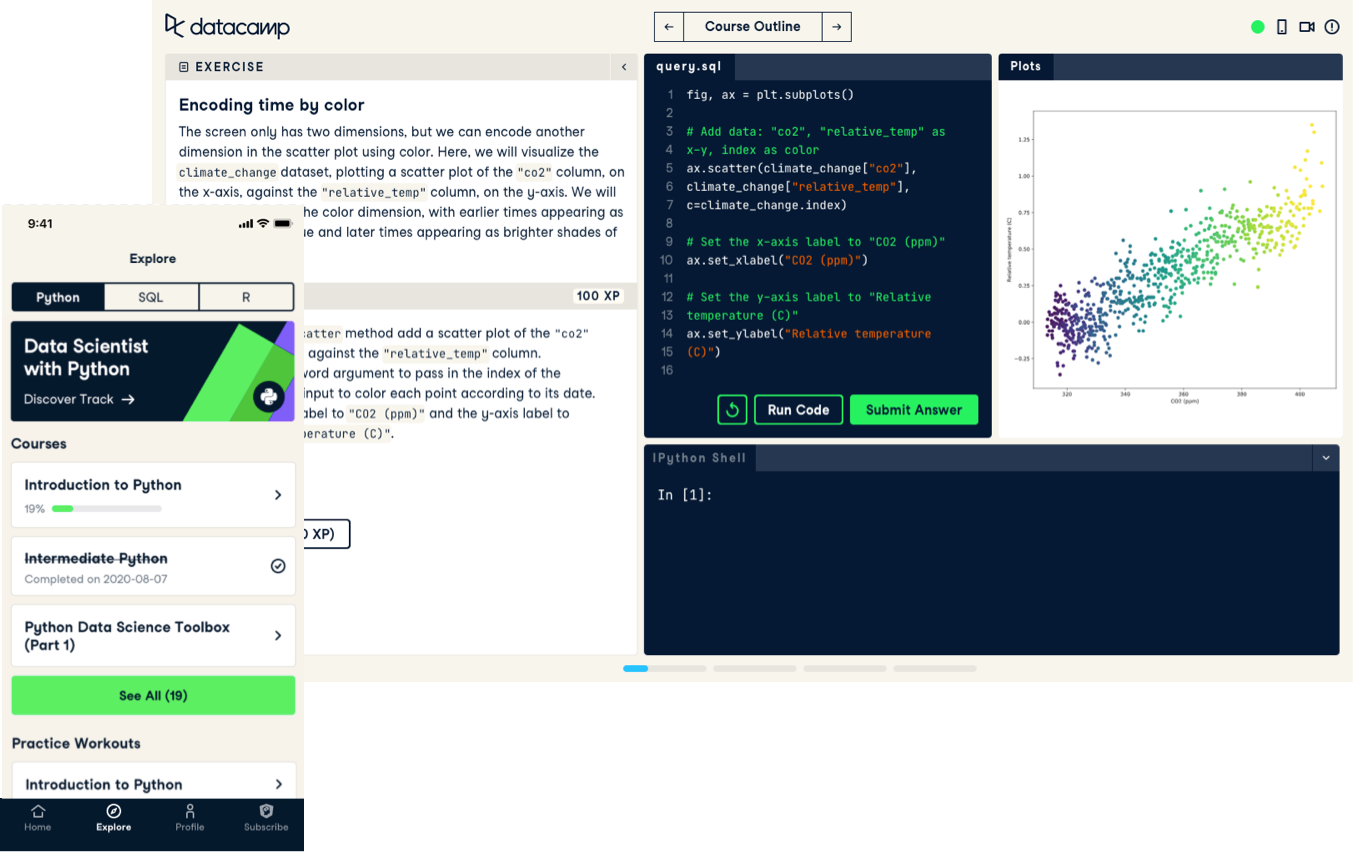

Follow short videos led by expert instructors and then practice what you’ve learned with interactive exercises in your browser.

Build Python skills to elevate your finance career. Learn how to work with lists, arrays and data visualizations to master financial analyses.

Learn about Excel financial modeling, including cash flow, scenario analysis, time value, and capital budgeting.

Build on top of your Python skills for Finance, by learning how to use datetime, if-statements, DataFrames, and more.

Learn essential data structures such as lists and data frames and apply that knowledge directly to financial examples.

Learn how to perform financial analysis in Power BI or apply any existing financial skills using Power BI data visualizations.

Learn how to prepare credit application data, apply machine learning and business rules to reduce risk and ensure profitability.

Learn how to calculate meaningful measures of risk and performance, and how to compile an optimal portfolio for the desired risk and return trade-off.

Learn to implement custom trading strategies in Python, backtest them, and evaluate their performance!

Using Python and NumPy, learn the most fundamental financial concepts.

Evaluate portfolio risk and returns, construct market-cap weighted equity portfolios and learn how to forecast and hedge market risk via scenario generation.

Learn about how dates work in R, and explore the world of if statements, loops, and functions using financial examples.

In this course, youll learn how to import and manage financial data in Python using various tools and sources.

Learn about risk management, value at risk and more applied to the 2008 financial crisis using Python.

Apply your finance and R skills to backtest, analyze, and optimize financial portfolios.

Discover how to use the income statement and balance sheet in Power BI

You will use Net Revenue Management techniques in Excel for a Fast Moving Consumer Goods company.

Learn basic business modeling including cash flows, investments, annuities, loan amortization, and more using Google Sheets.

Learn how to build a graphical dashboard with Google Sheets to track the performance of financial securities.

In this Power BI case study you’ll play the role of a junior trader, analyzing mortgage trading and enhancing your data modeling and financial analysis skills.

Learn about GARCH Models, how to implement them and calibrate them on financial data from stocks to foreign exchange.

Learn how to access financial data from local files as well as from internet sources.

Step into the role of CFO and learn how to advise a board of directors on key metrics while building a financial forecast.

Learn the basics of cash flow valuation, work with human mortality data and build life insurance products in R.

Apply statistical modeling in a real-life setting using logistic regression and decision trees to model credit risk.

Learn how bonds work and how to price them and assess some of their risks using the numpy and numpy-financial packages.

Learn to analyze financial statements using Python. Compute ratios, assess financial health, handle missing values, and present your analysis.

Work with risk-factor return series, study their empirical properties, and make estimates of value-at-risk.

Learn to use R to develop models to evaluate and analyze bonds as well as protect them from interest rate changes.

Advance you R finance skills to backtest, analyze, and optimize financial portfolios.

Learn the fundamentals of valuing stocks.